Source: Tax Foundation

June 15, 2017

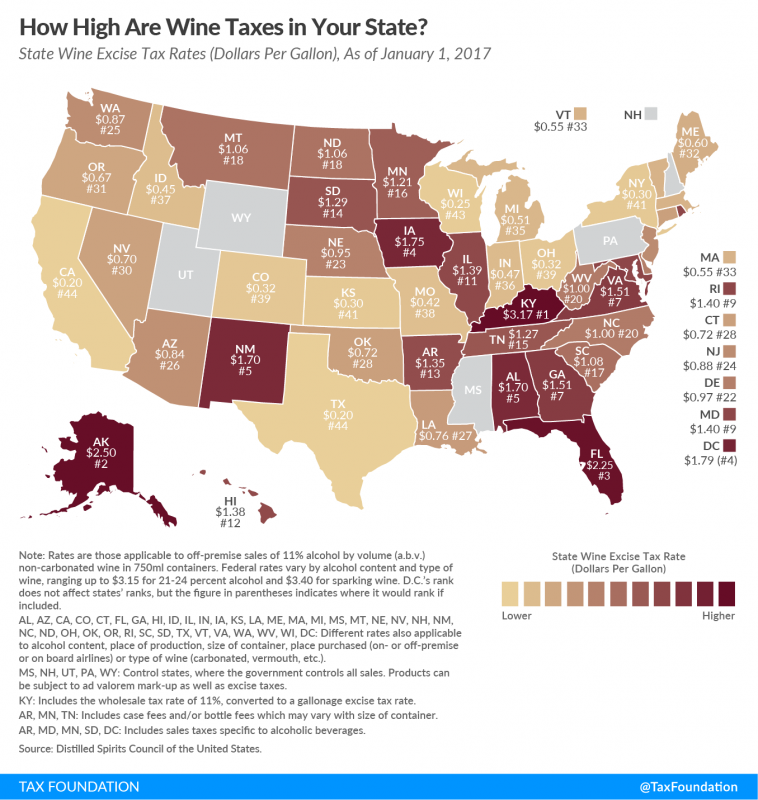

The treatment of wine differs extensively across the states, and at higher rates than beer because of greater alcohol content. Check out today’s map below to see where your state lies on the wine tax spectrum.

Kentucky has the highest wine excise tax rate at $3.17 per gallon, followed by Alaska ($2.50), Florida ($2.25), Iowa ($1.75), and New Mexico and Alabama (tied at $1.70). The five states with the lowest wine excise rates are California ($0.20), Texas ($0.20), Wisconsin ($0.25), Kansas ($0.30), and New York ($0.30). Notably, these rankings do not include states that control all sales (New Hampshire, Mississippi, Pennsylvania, Utah, Wyoming).

Wine excise rates can include case or bottle fees dependent on the size of the container, as in states such as Arkansas, Minnesota, and Tennessee. Additionally, rates may include sales taxes specific to alcoholic beverages and wholesale tax rates, as in Arkansas, Maryland, Minnesota, South Dakota, and the District of Columbia.

It should also be noted that many states apply varying rates based on wine type, and wines with a higher alcohol content are often subject to higher excise tax rates. Federal rates also differ by type and alcohol content, with wines up to 14 percent alcohol by volume (ABV) being taxed at $1.07 per gallon, wines between 14 and 21 percent ABV at $1.57 percent per gallon, and wines between 21 and 24 percent ABV at $3.15 per gallon. Sparkling wine gets its own category in the federal code, and is taxed at $3.40 per gallon regardless of alcohol content.

https://taxfoundation.org/high-wine-taxes-state/

Tax Foundation – Wine Tax by State